The CO2 Credit Paradox

- Andrea Ronchi

- Oct 30, 2024

- 4 min read

Few, essential, and destined to become extremely costly. Current potential demand is already 14 times higher than the available supply.

The Supply of CO₂ Credits

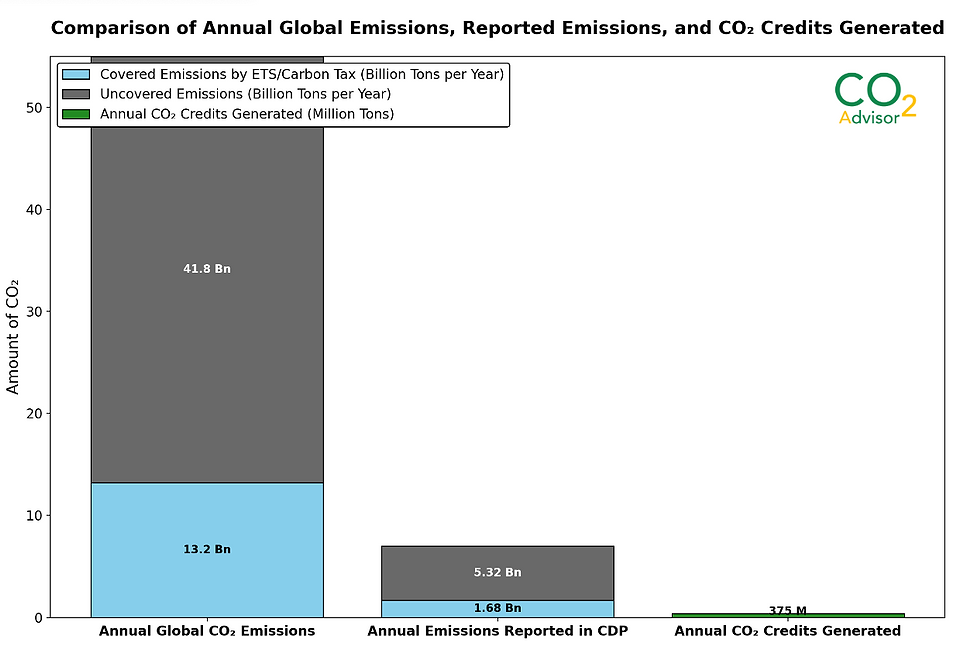

The current supply of CO₂ credits is drastically insufficient to meet potential demand, even when lower-quality credits are included. According to the World Bank, only 372 million credits are generated annually, covering all IETA ICROA-accredited program operators.

The Potential Demand

The global demand is vast. Each year, around 55 billion tons of CO₂ equivalents are emitted globally, with only 24% covered by mandatory carbon pricing mechanisms, such as ETS and carbon taxes. This leaves 41.8 billion tons that could potentially be offset through carbon credits. For example, in the CDP, over 23,000 organizations report around 7 billion tons of emissions per year, of which 5.32 billion tons are not covered by mandatory mechanisms. This demand is 14 times higher than current supply levels.

The Current Demand

Despite this, actual demand remains low. Fewer than 300 million CO₂ credits are purchased annually, resulting in depressed average prices at around USD 7.50, with significant variations from under USD 1 to USD 150, depending on the project.

The Market Paradox

Low demand and low prices fuels criticism from environmentalists, who argue that credits are a shortcut undermining decarbonization efforts. This perception, in turn, discourages development of new projects, affecting standards and policies and limiting credit use.

Resolving the Paradox

As we approach the 2050 checkpoints for decarbonization targets and exhaust the “low-hanging fruit” of emissions reductions, we’re reminded of the flexible mechanisms envisioned in the Kyoto Protocol. These mechanisms promote using market forces to allocate resources where they’ll have the greatest impact, directing investment to regions where the marginal cost of CO₂ reduction is lower. This approach achieves technological neutrality and encourages resources to flow into less developed regions, where starting baselines are more challenging and where each dollar invested has greater effectiveness.

In essence, we’re returning to the foundational principle of “a ton is a ton”—that is, it doesn’t matter who initiates emissions reductions or who funds carbon capture efforts, as long as, by the deadline, total global emissions are 95% below the baseline year.

Looking Ahead

CO₂ credits will soon become scarce and highly expensive. Analysts project that prices could exceed USD 150 per credit as early as 2030-2040. Demand will surge due to:

Increased openness of voluntary standards, like the Science Based Targets initiative (SBTi).

The reintroduction of CO₂ credits into ETS, as seen in proposed EU ETS reforms allowing credits from removal activities.

We’re currently witnessing the rise of organizations dedicated to establishing frameworks to classify the quality of CO₂ credits and regulate their application. These frameworks often specify how credits can be used, limiting their application to particular types of emissions, or placing restrictions based on factors like vintage and technology type. These measures aim to limit the pool of credits available, thereby supporting higher prices by controlling supply.

However, prices are likely to surge dramatically once CO₂ credits are inevitably reintroduced into both voluntary and mandatory carbon management systems. Simply planting more trees or accounting for existing forest absorption and reduced deforestation won’t suffice, even if sequestration rates are sometimes overestimated. What’s truly needed are advanced and costly technologies capable of removing unavoidable emissions, alongside efficient strategies to promote emissions reduction technologies that ensure sustainable impact.

Key Evidence

(to be explored further in upcoming articles)

Companies Off-Track:

The low-hanging fruit has been picked; further gains require increasingly unsustainable investments.

Global Trends: According to Accenture and MSCI, global corporate progress toward net-zero is slow. Only 18% of the world’s largest companies (G2000) are on track to reach net-zero by 2050. MSCI also indicates that emissions from listed companies are enough to lead to a 2.5°C global temperature increase, far above the 1.5°C target. While about 37% of companies have publicly committed to net-zero, only a minority have taken sufficient action to cut emissions at the necessary rate.

European Insights: The Zero Carbon Policy Agenda by the Politecnico di Milano's Energy & Strategy Group shows that direct GHG emissions in Europe fell by 32.18% from 1990 to 2023. But achieving a 55% reduction by 2030 will demand matching this progress over the next five years—an increasingly costly challenge.

Italy: Morningstar Sustainalytics finds that Italian companies in the FTSE Mib are far from reaching net-zero. With current policies, global temperatures could rise nearly 3°C, surpassing Paris Agreement targets. Few Italian firms have viable transition plans, while others are “severely misaligned,” based on Sustainalytics' Low Carbon Transition Rating.

The Importance of Market Mechanisms

Efficient resource allocation is critical, yet a top-down green agenda risks financial waste.

In Italy alone, €127 billion was allocated to decarbonization in 2023 (Energy Strategy, Politecnico di Milano). While the outcomes will be measurable in the coming years, consider this: from 2005 to 2023, Italian emissions fell by around 12 million tons, equating to about €10,500 per ton of CO₂ paid by taxpayers. The cost is higher when considering reductions attributed to offshoring and deindustrialization.

Two Tips for Companies and Policymakers

For Companies: Now is the time to get ahead of rising CO₂ credit prices by investing in emissions reduction technologies. Building net-zero strategies and compensation plans not only helps lower long-term costs but also enhances corporate reputation and prepares businesses for stricter regulations.

For Policymakers: Actively support the voluntary carbon market and encourage investments in emissions removal technologies. A flexible, market-integrated regulatory approach will channel resources toward efficient projects and accelerate progress toward global decarbonization goals.

Comments